Our Articles

BROWSE OUR ARTICLES TO LEARN MORE ABOUT RETIREMENT PLANNING, TAXES, AND MORE!

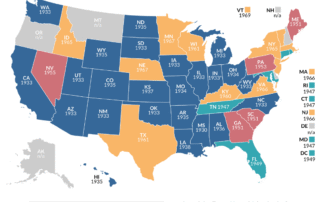

A History of the Sales Tax

Before we take a peek into the past to see how sales tax became a part of our lives, let’s define our terms. Sales tax is a tax on the sale or exchange of an item or service and is usually paid by the consumer or purchaser. It is a source of revenue for state and local governments to fund [...]

How Home Sales Are Taxed: What Every Homeowner Should Know

Selling a home is a significant financial event, and understanding the tax implications can help homeowners protect their profit and avoid unexpected liabilities. When you sell your residence, the gain you realize may be subject to capital gains tax, but in many cases, favorable tax rules can help reduce that tax burden. Let’s take a look at how the tax [...]

Income Tax vs. Capital Gains Tax: What’s the Difference?

Understanding the difference between income tax and capital gains tax is a key part of smart financial planning. While both are ways the government collects revenue, they apply to very different types of money you receive. Here are the questions you most likely have, and the answers that can help you understand the basics of these two tax categories. Q: [...]

Tax Updates for 2026: Key Things to Know This Year

Thanks to the permanent changes made by the “One Big Beautiful Bill Act” (OBBBA) and the annual inflation adjustments from the IRS, the 2026 tax year brings some changes you might want to make note of. Getting a handle on these updates can help you plan out your financial moves throughout this year, so let’s take a look at some [...]

A How-To Guide to Your “my Social Security” Account

While the Social Security Administration will still mail you a statement once a year if you’re over the age of 60, they really encourage everyone to create a “my Social Security” account for better security and easier access to forms and information. With an online account, you don’t have to wait for the mail to arrive or worry whether you missed your letter, and [...]

Your 2026 Social Security Cost-of-Living Adjustment: The Good News, The Bad News and What It Means for Your Retirement

Every October, over 70 million Americans eagerly wait for the Social Security Administration (SSA) to announce the Cost-of-Living Adjustment (COLA). This annual bump is designed to help your benefits keep pace with inflation, but will this actually help you cover your expenses, and what does this adjustment really mean for your wallet? Let’s take a look at these questions and [...]

Give the Gift of Financial Planning This Holiday Season

As we gather with family and friends this week, many of us have spent time picking out the perfect gifts to wrap and lovingly place under the tree. We eagerly await them opening our gift and sharing in the joy we had while selecting it especially for them. And though traditional presents like gadgets and gift cards are always appreciated, [...]

Should I Keep My Retirement Account or Use Annuities?

Deciding whether to keep your retirement savings in accounts like IRAs or 401(k)s versus transferring those funds to an annuity is a question many people face as they approach retirement. But before we jump in, there’s no rule that says you have to pick one, and both offer different benefits and come with different limits and risks. In order to [...]